Get back on track — with our creative mortgage solutions.

Life happens! And when it does, sometimes it can have a negative effect on your credit. That doesn’t mean all hope is lost for your mortgage needs.

At iMortgage Canada, our friendly brokers have over 30 years of experience in alternative lending. We’ve helped thousands of deserving Canadians, like you, turn their credit from a negative into a positive situation.

While your rates and fees may be higher at the start, we work with you over time to get you back into the low bank rates you deserve — giving you the tools to improve your credit, so that you can rebuild as quickly as possible.

We provide targeted advice based on your unique situation. Contact us today, and we’ll get started!

What You Should Know

- Insured mortgages require a credit score of at least 600, while banks generally require a score of 600 or higher

- If you have bad credit, you’ll need to consider getting a mortgage with a B lender or a private mortgage lender

- Many private mortgage lenders have no minimum credit score requirement, which is perfect for those with bad credit

- Bad credit mortgages are only meant to be a temporary measure while you build back up your credit

- The goal is to switch back to a traditional lender once your term is over

- Bad credit mortgages will have higher interest rates and may have higher fees

- Some banks offer special mortgages to newcomers with no Canadian credit history

- If you have no credit history, some lenders might consider alternative credit data, such as 12-months of rental payment history

How to Get a Mortgage With Bad Credit in Canada

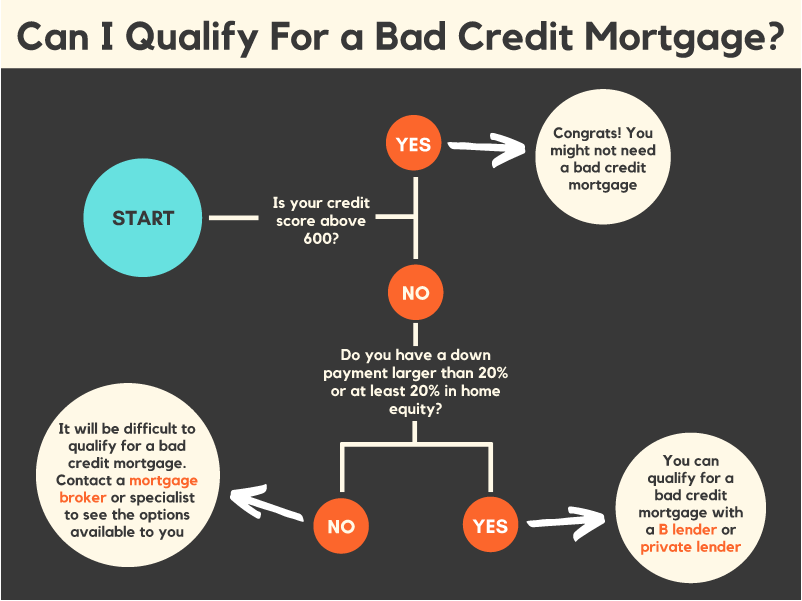

Most banks in Canada require a minimum credit score of at least 600 to get a mortgage, which means that having a credit score less than 600 will cause you to be rejected by Canada’s major banks. Many private mortgage lenders have no such requirement, and so they and B lenders are some of the only alternative mortgage lender options available to those with bad credit.

Getting a bad credit mortgage from a private lender is an option since private lenders are more flexible and have less stringent lending requirements compared to the major banks, and so they can help you no matter your financial situation. Rather than focus on your credit score and credit history, private lenders will place more emphasis on your home equity. If something goes south and you default on your bad credit mortgage, private lenders want to be able to sell your home quickly through a power of sale while recouping the full amount of their investment.

However, be aware that a private mortgage can be much more costly than one from a traditional bank. Private mortgage rates can be multiple times higher than regular mortgage rates. You’ll also need to have a large down payment or home equity, as in a low loan-to-value ratio (LTV), in order for private lenders to take on your bad credit mortgage. Since having a low LTV will make it easier for private mortgage lenders to recoup their lost investments on defaulted bad credit mortgages, private lenders can even work with those who have recently gone through a bankruptcy.

B-Lenders can be another option for those with bad credit. You can use the friendly brokers at iMortgage Canada to help connect you to B-Lenders and private lenders. For example, Home Trust and Wyth Financial mortgages target those with bad credit scores or with non-traditional income. B-Lenders and private lenders may charge additional fees to your mortgage, which can significantly add onto your cost of borrowing. These fees are usually based on the total amount that you are borrowing.

So you’ve checked your credit score, and it doesn’t look good. There’s no need to panic! Follow this tip, and you’ll be on your way to affordable homeownership in no time.

Improve your credit score

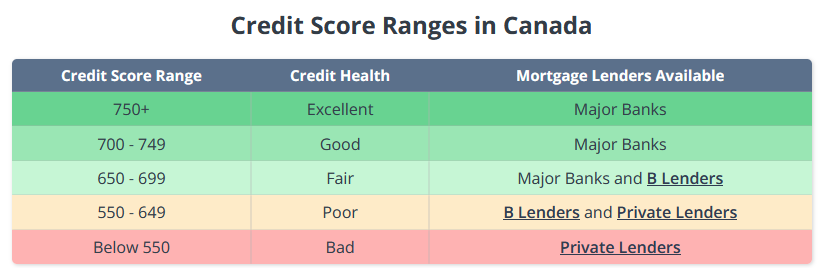

As you can see from the table above, a higher credit score is beneficial because it helps you secure a lower mortgage rate, which results in lower monthly mortgage payments. If you’ve checked your credit score and it’s too low to qualify for a mortgage from the big banks (often referred to as ‘A lenders’) you may want to spend some time improving your credit score before applying for a mortgage.

Here are our top tips for improving your credit score:

- Pay your bills on time: Never miss a monthly payment on any of your bills, including debt payments, utilities, even your cell phone bill. If you can’t pay the bill in full, don’t ignore it, as that will just cause it to go into delinquency, harming your credit score. Instead, contact your provider about a payment plan.

- Stay under your credit limit: Try not to use more than 30% of your available credit limit on your credit cards or lines of credit. This shows credit reporting agencies that you are a responsible spender and not over-extended. (quick tip…ask you credit company to raise your limit)

- Don’t apply for too much new credit: Don’t apply for too many credit cards, as this can be a red flag to credit reporting agencies that you need cash fast.

- Keep your oldest account: The length of your credit history matters. Canceling old credit cards removes them from your file and shortens your credit history. Consider keeping your oldest credit card open – even if you don’t use it – to maximize the length of your credit history.

If you apply these tips to your finances, you should see your credit score start to increase after a few months. If you need to purchase a home before you qualify for an A lender mortgage, you can still apply for a mortgage from a trust company or private lender.